Can WhatsApp Pay Woo Indians?

- Vinay Nair

- Feb 15, 2020

- 8 min read

Updated: Feb 17, 2020

For any tech savvy adult with a smartphone and bank account in India, the overwhelming availability of online payment options is a part and parcel of daily life. There is always some UPI payments app offering cashback if you buy groceries from a partner platform, while yet another payment app lures you with attractive food delivery discounts.

Figuring out the most lucrative deals from all the referrals and cash back can be both addictive and exhausting, and few would think India has any appetite left for yet another payment app.

But India's digital payments industry is slated to reach a trillion dollar valuation by 2023, and few giants can resist that sort of a temptation; especially if it comes straight from one of the fastest growing emerging markets in the world. After all, several of the most recognisable global behemoths have already shown up for their share of the pie, plotting to grab as large a piece as they possibly can.

Google Pay, Amazon Pay, PhonePe (by Walmart-owned Flipkart) have all been trying to flex their muscles for a while now, desperate to beat PayTM and each other in this game of thrones. With such wildly competitive players in the fray, one would think that the arrival of a new kid on the block would be lukewarm at best. However, when the new kid in question is WhatsApp Pay, backed by the combination of Facebook's mammoth resources and WhatsApp's massive reach, you know the response will be different!

WhatsApp Pay has been in the works for a while now, as the payment arm of Zuckerberg's ubiquitously loved messaging app moved to capture its existing customer base for a new purpose. The service had a small scale beta run sometime back in partnership with the ICICI Bank, and the Reserve Bank of India greenlighted a third party security audit of its practices in October 2019. Yet, despite repeatedly making headlines for making inroads into the Indian market, WhatsApp Pay was unable to secure a go ahead from the National Payments Corporation of India (NPCI).The process of securing an approval was delayed by disagreements over data localisation regulations, even during the trial phase.

But finally, putting all our anticipation to rest,

The brand new payment service managed to get a nod from the NPCI recently, paving the path for a rollout among 10 million of its more than 400 million users.

The rollout will be carried out in phases and the data collected will reportedly be housed in India for the time being.

Why WhatsApp Pay Has an Edge?

While the current market scenario suggests that it is inching towards a saturation point, WhatsApp Pay has an important differentiating factor that gives it a much-need edge.

WhatsApp recently reported that it has breached the 2 billion mark in terms of the numerical strength of its user base, and this number is second only to Facebook, its parent company and the world's most well known social media network.

Although the messaging app has widespread popularity in the global stage, it has found its largest market in India.

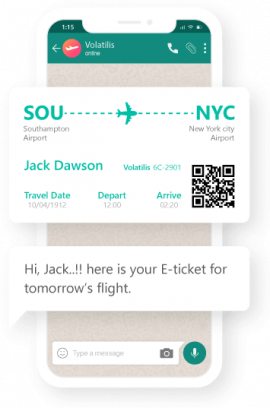

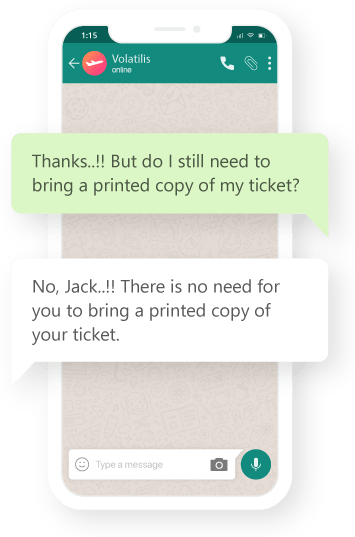

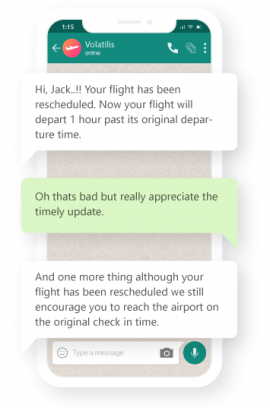

With the number of smartphone users increasing by leaps and bounds every year, India sees everything from daily greetings to political propaganda delivered by WhatsApp. The absolute ubiquity and convenience of this primarily free app has made it the communication channel of choice for several businesses as well, with the likes of BookMyShow, Nykaa, and OYO delivering confirmation directly into users' WhatsApp chats.

In fact, more Indians also seem to be receiving (fake) news via WhatsApp before traditional journalistic sources reach them these days. While this has caused a host of conflicts and violent incidents around the country, it has also gone on to reflect WhatsApp's immense power of boosting national connectivity.

This massive customer base is a factor that immediately trumps most other competitors who are operating in this sector.

The immense brand loyalty and familiarity associated with WhatsApp immediately gives it a prime position in the minds of potential customers.

Moreover, WhatsApp Pay can potentially facilitate in-app payments to local businesses. For example, someone chatting and placing an order with a local baker can immediately make payments from the same app to confirm the transaction. Besides, WhatsApp seems to have the potential to address a few issues that are inherent in India's digital payments landscape. My personal experience suggests that digital payments via UPI apps have so far remained the reserve of young to middle-aged working professionals comfortable with using technology. This tendency has restricted the growth of these apps' user base to a certain extent, registering their inability to capture a more varied demographic. However, since WhatsApp is more universal in its appeal, and widely familiar, it is quite likely that it will be able to initiate some new users into the world of digital payments. So many of our parents are already all too eager to believe that UNESCO has really declared the Indian anthem the best anthem in the world! If only they place the same faith in WhatsApp Pay as they do in WhatsApp University, Zuckerberg's executives would have much less to worry about.

Jokes apart, another aspect where WhatsApp Pay may enjoy a strong competitive advantage is the wealth of data its parent company has amassed from users, both in India and globally. While the heavily stocked repositories of data held by Facebook is a contentious issue giving rise to privacy and other concerns, the presence of this data can give a big boost to WhatsApp Pay itself. Data collection, processing and the formulation of business analytics and actionable insights are crucial aspects of devising a strategy in any business.

But in a service like digital payments, a nuanced understanding of consumers' purchasing and spending habits can become all the more important.

Knowledge of such imperative details can guide policies adopted by WhatsApp Pay, and easily shape the payment practices of users before they can realise it.

Concerns Around Data Privacy Persist

Ever since the Cambridge Analytica scandal rocked the world, many of us have never been able to look at Facebook the same way again.

While it is entertaining, informative, and quite integral to modern living, Facebook does not have the cleanest record when it comes to collecting and using their users' personal, often sensitive data.

From potentially delivering targeted propaganda to the comparatively innocent data transfers for showing ads, Facebook has repeatedly fallen short of a reasonable explanation of exactly how it handles user data. WhatsApp is essentially a part of the Facebook family, and while the personal chats are said to be encrypted from end to end, many users have voiced suspicions over the use of their personal text messages to guide advertising decisions. In such a situation, having to hand over sensitive financial data to WhatsApp Pay has begun to worry many. Facebook's dubious reputation for data management and privacy protection can pose some questions and potential challenges for WhatsApp Pay as it eventually rolls out nationwide.

Competitor Analysis

Once WhatsApp finally unveils its payment service for the entirety of the Indian population, it will have to take on the likes of homegrown payments king PayTM and international superstar Google Pay.

PhonePe is also a worthy contender, with Amazon Pay making sporadic attempts to take over the scene. Google Pay may just be the greatest threat of all, given that it is still riding high on the "gamification" strategy it implemented during last Diwali and the run-up to New Year. Although PayTM still rules the roost, boasting of 140 million monthly users in 2019, Google Pay is fast catching up with its swanky interface, interesting collaborations and the addictive scratch cards. It reported having 67 million users in the last year, and the numbers are fast climbing to enviable levels.

Airtel Pay has also made some attempts to establish their presence, if not dominance, and PhonePe has maintained a steady grasp over its loyal user base of 55 million people in 2019. Although PhonePe has attempted to diversify into the offline space by pitching ATM services as well, the growth of Walmart's war horse has been just slow and steady without much hope that it can win the race.

The overall digital cash payments market, including other forms of non-cash transactions in India, is growing at a compounded annual growth rate of 12.7%.

This leaves considerable room for the players to claim the largest share of this considerable growth. Apple Pay is also planning an appearance soon, crowding the space further, and heightening competitor concerns.

Although Apple has always been on a rocky footing in the Indian market, its remarkable brand recognition can potentially catapult it to success, especially among the more affluent users who are accustomed to the Apple experience.

Can WhatsApp Become a Super App?

Super apps are a concept that have become all the rage in China, and some of the other South Asian regions. Oddly, however, India has not really warmed up to this idea at all.

A Super App refers to a mobile application offering a bouquet of services under one umbrella interface. Various kinds of options available via such apps include bill payments, movie reservations, transport bookings, hotel deals, food delivery, fashion, gaming and more. A super app combines all the essentials of entertainment and convenience in a single window to make it easier to use and navigate. For Indians, many of whom use cheaper Android smartphones with storage constraints, super apps could potentially be an extremely convenient tool to navigate the increasingly online realities of our existence.

However, deal-hunting Indians have so far been shy of committing to one super app for all their needs, and few companies have managed to flesh out the idea to any convincing extent.

However, as WhatsApp Pay is rolled out, this may just change soon, as Indians have long committed to WhatsApp as the be-all and end-all of their messaging needs. It may still be somewhat difficult to strategize and implement, but if any company has the ability to transform the space, it is WhatsApp. It can combine communication with payment, which are the two cornerstones of any successful transaction.

Now that WhatsApp Pay is being rolled out in a limited manner, it is hard to predict if it will indeed be able to mirror WeChat's stupendous success in China and worldwide. At this stage, it is sufficient to note that it does have the potential, and it is all about how Zuckerberg's team wants to play the cards now.

What this Means for the Industry?

WhatsApp Pay is undoubtedly an exciting addition to the Big Fat Indian family of digital payment apps, even as they try to jostle each other out of this frankly overcrowded family photo.

As the new kid, WhatsApp Pay is probably the equivalent of an MBA graduate who lands straight from a swanky college abroad, armed with just the right amount of Indian "sanskar". While this may position it for a resounding welcome, it will have to prove its mettle to earn its place and carve its niche.

As the industry soars to great heights, with about 12.7% Indians converting to the cause every year, there is ample scope for everyone to grow.

The acid test will lie in how much of this growth these apps can keep for themselves, and how well WhatsApp Pay fares against PayTM and Google Pay.

As the effects of the controversial demonetisation slowly fade from our distinct memories, digital payments will have to double down on the convenience factor to attract and retain customers.

The rate of adoption is particularly slow in the rural areas, which will have to be addressed if the industry is to experience any kind of maturity in the near future.

A vast number of rural people in India are still unbanked, making it difficult for them to convert to the idea of paying on their smartphones.

Even though the rate of internet penetration and smartphone adoption remain high in these areas, digital payments giants will have to join forces with the government and the banks to woo the rural populace to go digital.

While the urban population will remain a substantial source of their popularity, these apps would ideally have to connect the rural populations to truly go pan India.

As for WhatsApp Pay, it has a strong footing in both urban and rural India, making it a strong candidate for leading the change.

There will be a lot of strategic considerations to address and hurdles to cross, but with clearer data policies and a comprehensive market penetration policy, WhatsApp Pay should be able to make the most of all the opportunity at hand.

Comments